Global Thinkers.

Trusted Advisors.

With clients across the United States and internationally, Murison Arbor is a boutique advisory, accounting, and tax firm providing high-quality, partner-led services to businesses, individuals, and families. We focus on delivering thoughtful, efficient solutions that align with our clients’ business objectives, personal goals, and risk profiles.

Our work spans domestic and cross-border matters, supporting public and private companies, growing enterprises, private clients, and family offices through both routine and highly complex situations. We approach each engagement with creativity, discipline, and informed judgment—helping clients navigate transactions, regulatory requirements, and structural decisions across industries and jurisdictions.

US $10K-$100M+

Range of Projects

Our legal teams regularly handles simple to complex projects for U.S. nexus clients across the globe.

100+

Awards, Certifications & Honors

ZLG’s experienced legal team received a wide variety of recognitions.

27

Countries With Zahn Law Clients

We have a global reach supporting clients in different legal and cultural regimes around the world.

LATEST NEWS:

The Corporate Transparency Act A New U.S. Reporting Obligation Many Business Owners Overlook

Not long ago, a foreign individual could form or register a company in the United States with minimal disclosure. In many cases, public filings did not require identifying the real people behind the entity. Once the company was formed and routine tax filings and annual state reports were completed, most owners reasonably believed their compliance obligations were complete.

Just Set Up an LLC — How a Common U.S. Business Tip Can Trigger a $25,000 Penalty for Foreign Owners

We regularly see the same story repeat itself. A foreign entrepreneur follows professional advice, forms a U.S. LLC, opens a bank account, and starts operating. No one asks whether the owner is U.S. or foreign. No one explains the hidden reporting rules. Years later, the client learns—often from an IRS notice—that they missed a filing they never knew existed.

The Corporate Transparency Act A New U.S. Reporting Obligation Many Business Owners Overlook

Starting in 2024, the Corporate Transparency Act requires most U.S.-connected companies to report beneficial owners. Non-compliance carries serious penalties, and foreign-owned businesses face higher risk without early compliance planning.

Just Set Up an LLC — How a Common U.S. Business Tip Can Trigger a $25,000 Penalty for Foreign Owners

“Just set up an LLC” can be dangerous for foreign founders. Hidden IRS reporting rules can trigger $25,000 penalties—even with no income—making early structuring and compliance critical.

Leave America Hello Exit Tax

U.S. exit tax rules impose a mark-to-market tax on covered expatriates and a 40% tax on U.S. recipients of their gifts or bequests. Proper classification, valuation, and timely filings are critical to avoid severe penalties.

NY Corporate Tax Update — Estimated Tax Threshold Raised in 2026

Effective for tax years beginning January 1, 2026, New York State has raised the estimated tax payment threshold for corporations subject to Article 9‑A from $1,000 to $5,000. As a result, corporations with prior tax liabilities of $5,000 or less — and those that reasonably expect their current year tax after credits to be $5,000 or less — are no longer required to make quarterly estimated tax payments during the year. This change aims to reduce compliance burdens on small businesses and simplify cash flow management while maintaining annual filing obligations.

One Big Beautiful Bill

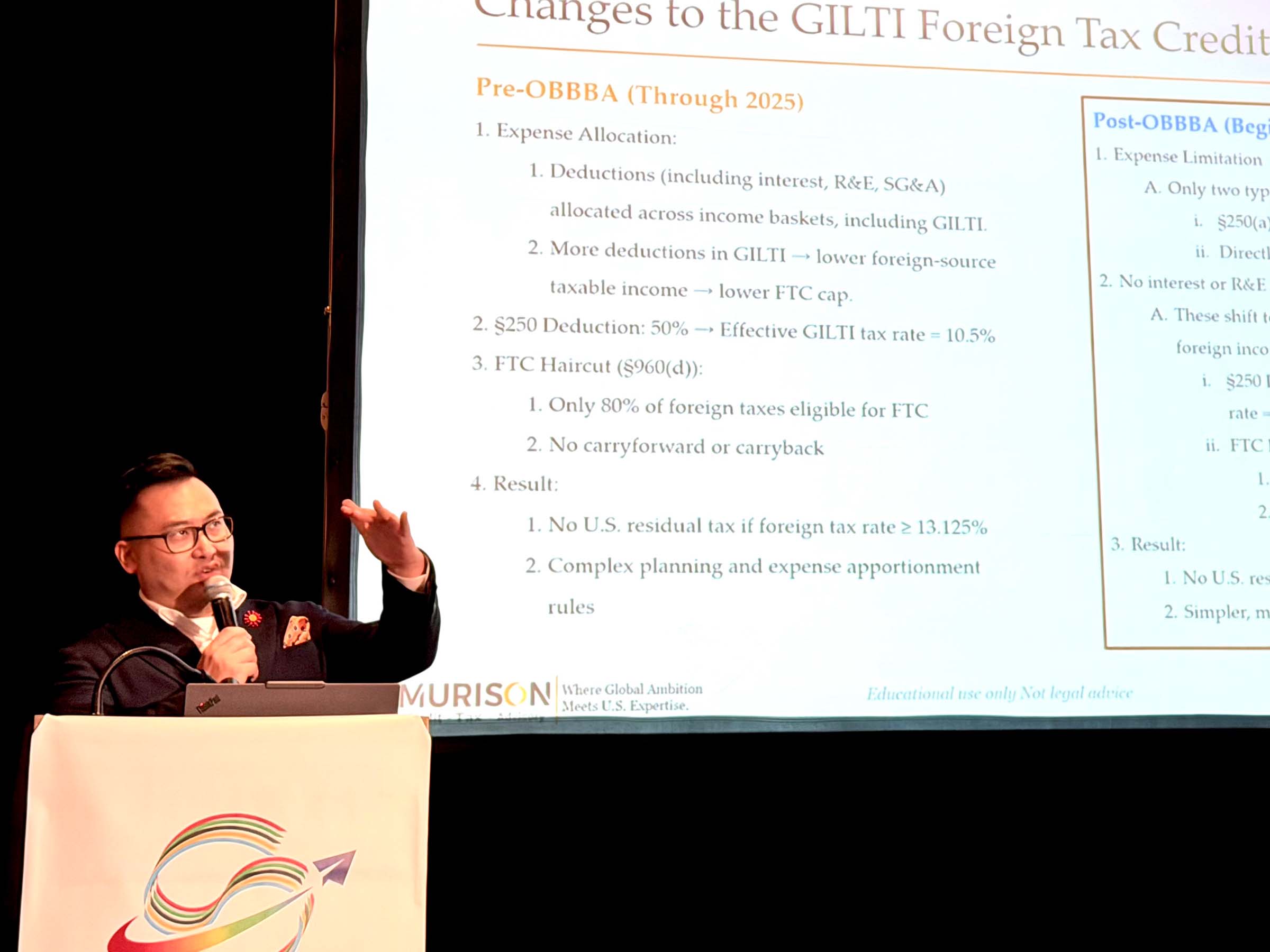

The latest U.S. international tax update provides important guidance for multinational corporations. Under the OB3 Act, key changes affect how global income is taxed, including adjustments to GILTI (Global Intangible Low-Taxed Income) and FDII (Foreign-Derived Intangible Income) rules, potentially impacting effective tax rates and deductions. In addition, the IRS has increased penalties for failing to file required foreign information returns, such as Forms 5471, 5472, 3520, and 8938. Noncompliance can result in substantial fines, monthly accruals, and interest charges. These updates highlight the need for companies and individuals with international activities to carefully review reporting obligations, ensure timely filings, and implement robust compliance procedures to avoid significant financial exposure.

Customer reviews